How to Troubleshoot the NY Interest Swap [2-S-5-F4] in Collection-Master

The goal of this document is to better understand how the New York Interest Swap program recalculates interest from the existing rate (typically 9%) to 2% on New York post-judgment cases.

South District of New York – Preliminary Injunction

Vertican cannot provide legal advice, but it is worth reviewing this injunction and deciding what your actions should be. You can download a PDF of the injunction, which was filed 4/28/22.

Decisions Your Firm Needs to Make

Here are some options your firm has to consider regarding the new law.

- Run the new New York Interest Swap option [2-S-5-F4] to retroactively recalculate interest from 9% to 2%.

- Use the existing Swap Interest Rate option [2-S-5] to proactively calculate interest at 2% going forward. Your options are:

- Switch claims to 2% as of 4/30/2022 and calculate 2% going forward.

- Switch claims to 0% and freeze interest!

- Use your own methodology to create a firm-specific solution.

- THERE IS NO UNDO!

New York Interest Program Methodology

The New York 9% to 2% project requires looping through the FINAN transactions to recalculate interest for each transaction.

- Make sure you are running Collection-Master 9.1G.023 or newer.

- Legal information about this project is in flux; make sure you understand what you are doing.

- Only post-judgment cases will be recalculated.

- You should consider picking specific claims to be updated.

- Is the claim a consumer debt?

- Was interest accruing at 9% before?

- Effective State must be “NY”.

- Interest will be reset to $0.00 on the Judgment Date.

- For each entry after judgment, the Interest Base pulled from the claim will be used to accrue interest at 2%.

- If interest was collected, then the accrued interest will be increased to include the amount collected. This means that any 9% interest previously collected will be charged to the claim. We call that amount “Max_Int_Coll”.

- Similarly, if a transaction reverses collecting interest, “Max_Int_Coll” will be reduced.

- The Max_Int_Coll transactions only apply to payments applied before 5/1/2022. So if you recover interest after that date, it will not increase the ‘Max_Int_Coll”.

- Historical transactions are not changed and will show the running interest balance that applied at the time.

- A new “Interest Stamp” with a code of “90.09100” will be added to the claim showing the new values for interest.

- Two new log files will be created in the F:\CLSINC\NY_INTEREST folder.

NY_INTEREST Log Files

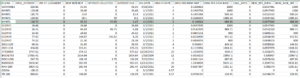

When you run the program, two separate log files will be created:

- NY_INI_CCYYMMHHMMSS.csv

This log file shows claims that were updated along with some information about the calculations.

|

Orig_Interest |

Interest accrued before the routine was run |

|

Int at Judgment |

The starting amount of interest at judgment date (always 0). |

|

New Interest |

Interest accrued at 2% |

|

Interest Collected |

The amount of interest collected after judgment. |

|

Interest Due |

Interest Balance |

|

JDG Date |

Judgment date used for the calculations. |

|

Orig PJ Rate |

The post-judgment interest rate assigned to the claim before calculations. |

|

Orig Per Diem Amt |

This is the daily interest rate going forward before the routine was run (usually 9%). |

|

Orig Per Diem Base |

This is the daily interest base going forward before the routine is run. |

|

Calc_Days |

This field was used to show the # of days used to recalculate interest. Now it’s 0 since the itemized log provides detail (Always 0). |

|

New_Per_Diem |

This is the daily interest rate going forward after the routine was run (usually 2%). |

|

New Base_int |

This is the daily interest base going forward after the routine is run (usually the same as original Per Diem Base). |

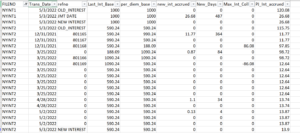

- NY_INT_CCYYMMHHMMSS.txt

This additional log file shows itemized transactions about the interest calculations in the new program.

|

FILENO |

The claim being processed. |

|

Trans_Date |

The date of the transaction in FINAN. |

|

refno |

If appropriate, the TA or Reference # from the financial transaction [F1-F2].

|

|

Last_Int_Base |

Last_Int_Base is first pulled from the claim and then from each financial transaction.

|

|

per_diem_base |

Per_Diem_Base reflects the new base after the transaction is processed. It shows the impact the transaction will have on future calculations. |

|

new_int_accrued |

This is the new interest accrued for the time period. |

|

New_Days |

New_Days provides the # of days used to accrue the new interest. |

|

Max_Int_Coll |

This is an adjustment to the formula reflecting the interest that was collected. |

|

PJ_Int_accrued |

This is the running Interest Balance showing the results of the transaction. |

Multi-State

You may wish to review the Multi-State Mastermind video and presentation and to check Collection-Master Multi-State Settings [1-S-4-W].

Collection-Master firms should review their Multi-State settings on vPortal and subscribe to a new state, if desired. Select:

-

Collection-Master > Multi-State

Once there, select the state you would like to subscribe to.

Note: Before subscribing to Multi-State, please watch Multi-State Mastermind video since subscribing will add new options to Collection-Master, and you will need to configure Collection-Master properly. Note that “Unknown State” is a Multi-State option, and those settings are used as a default, but you want to confirm all the settings.

Submitting a Support Incident

-

Make sure you have installed CM 9.1G.023 or newer.

-

Provide both log files that include the impacted claim.

-

F:\CLSINC\NY_INTEREST\NY_INI_CCYYMMHHMMSS.csv

-

F:\CLSINC\NY_INTEREST\NY_INT_CCYYMMHHMMSS.txt

-

-

Provide screenshots of both account cards.

-

Interest Account Card

-

Judgment Account Card

-

-

The log files and screenshots are your troubleshooting tools and should contain the answers to your questions.

-

If you would like to have a Client Success member review the results, please open a support request and arrange for professional services.

Q & A

Q: Why was my claim not processed by the routine?

A: When running the program, there are filters that you may enter; those filters include selecting a list of claims. In addition, only claims with an Effective State of “NY” (See Interest Account Card) will be processed.

Q: Why is there “No Undo”?

A: Interest is dependent on time and the dozens of factors at each point in time. The new program uses a simple methodology of calculating 2% based on the running Base Interest. An undo process would need to restore interest based on unknown factors.

Q: Why have there been changes to the project?

A: Vertican does not and cannot provide legal advice. We asked our firms to provide clarification and did not receive clear answers. As our understanding of the requirements increased, we made enhancements. In addition, literally two days before the required implementation date, an injunction was filed, adding additional confusion.

Q: Why is the programing being delivered at the last moment?

A: We did not receive a request to implement this feature until late March. Any development project must go through business analysis, development, quality assurance, and finally, documentation. Typically each of these phases takes two to eight weeks. Given the timeline, we had to complete eight weeks of work in a much shorter period. In addition, many states have changed their interest rates before, and there is an established process that works well. Based on the information provided, we did not think that we needed to completely recalculate interest from scratch.